(it's good news...)

Over the course of the past year preservationists have been working endlessly to defend and retain the Historic Preservation Tax Credit Programs. Thanks to the work of many, both the federal and the state programs have survived the threats of the recent federal tax reform and a state budget line item veto* from Governor Walker (*so far!).

STATE OF WISCONSIN STATE CREDITS:

Below are links to last week's coverage of the Wisconsin State Legislature approval of the new $3.5 million per project cap. This cap, while less than ideal, is a huge relief when compared to Governor Walker's $500,000 line item veto of the proposed $5,000,000 cap. The bill passed in the state Senate 29-3 and unanimously in the Assembly. It now heads back to Governor Walker to sign into law. Fingers crossed that the figure will remain untouched.

LINKS TO WISCONSIN MEDIA COVERAGE:

STATE OF THE FEDERAL CREDITS:

The Federal Program was threatened in December when the House voted to abolish the decades old incentive program. The final bill passed in late December kept the Historic Preservation Tax Credits however pushes the timing for receiving the funds from a project’s opening to over the course of the first five years of operation. We plan on diving further into the potential consequences of this shift of timing of the receipt of the credits in another post.

Read more about the Federal Program status here:

We can collectively say this news is a huge relief for Historic Preservation and economic development in the US. If you're new to this topic or brushing up on the programs below are a few points to consider. Here at the Trust we field many questions about the program and are outlining frequently asked questions below in an overview.

WHAT ARE WISCONSIN'S HISTORIC PRESERVATION TAX CREDITS?

Historic Preservation Tax Credits are crucial to supporting economic development in Wisconsin. These programs create new jobs, increase property tax revenues and grow communities across the entire state.

Despite the indisputable value of these programs there are still many people unaware of the programs or misinformed about the mechanics. If you're like us you may face many questions about the basics of the tax credit programs. When out in the field as a design professional or when interacting with family or friends it's surprising how many people are unaware of the existence of these valuable programs. Many building owners are unsure if their projects would qualify or if it's worth the time to navigate the application process. Experienced developers as well as those just beginning to research how they will be able to create/recreate a historic project have questions. Shoot us any you have and we'll continue to tackle the unknowns.

There is a range of people's exposure to the details of the programs. We're going to sort the questions from people who've never heard of the program to the savvy project owner who has benefited from the programs on past projects.

WHAT ARE HISTORIC TAX CREDITS?

If you're planning work on a historic building you may be eligible for a tax credit issued from the government. There are programs available for rehabilitation of historic properties from both the Federal Government as well as the State of Wisconsin.

For commercial projects presently the federal program returns 20 percent of the cost of rehabilitating historic buildings to owners as a federal income tax credit. While the State of Wisconsin program returns 20 percent of the cost of rehabilitating historic buildings to owners as a Wisconsin income tax credit (with an anticipated $3.5 million cap in effect starting in July).

DOES MY PROJECT QUALIFY?

Is your project currently listed on the National Register of Historic Places? If not you can pursue listing the building. To qualify for the tax credits the historic listing can be either an individual property listing or its possible that your project will qualify if it's included within a historic district recognized by the National Register. The National Register is maintained by the National Park Service under The Department of the Interior. Head over to their search engine if you're not sure about your building's present status.

Building Type: For eligibility under the current programs there are two types of listings that determine which tax credit program your building qualifies for - it'll be either categorized as a historic home or a historic commercial building..

We listed the commercial building benefits above as these projects are the majority of tax credit recipients. If you’re the owner of a historic home presently the historic homeowners' tax credit is a dollar-for-dollar reduction in what you owe in Wisconsin income taxes. The amount of the credit is 25 percent of your costs of carrying out eligible work. If your credit is larger than the amount that you owe in state income taxes, you can carry the unused balance into future tax years (up to 15 years into the future) until the credit is used up. The best resource to answers to your questions about the State's program is the Wisconsin Historical Society. Here's a link to their site including a very informative FAQ section for both building types.

IS THIS PROGRAM A GOVERNMENT HAND OUT?

NO! It's essentially an incentive program to help offset the high initial costs of rehabilitating historic structures. There are so many reasons rehabilitation makes environmental, cultural, social and economic sense. Bottom line is the reuse of historic buildings strengthens our communities. If you're interested in learning more about specific metrics about the quantifying of these aspects such as existing embodied energy or the increased quality of life studies we're planning a post to link to some of our favorite studies. Until then one easily digestible read for you to understand the economic importance of these programs is this study conducted by Baker Tilly and UWM's School of Architecture and Urban Planning's Historic Preservation Institute. It's a recent in-depth economic analysis of projects that received tax credits and very telling about the value of the state program.

We’ve pulled out a few highlights incase you're clicking over and feeling the TL;DRs.

Myths about the program we've heard over these years followed by excerpts invalidating these misunderstandings pulled from the study's Executive Summary:

MYTH: ONLY SAVVY BIG CITY DEVELOPERS BENIFIT FROM THESE GOVERNMENT PROGRAMS

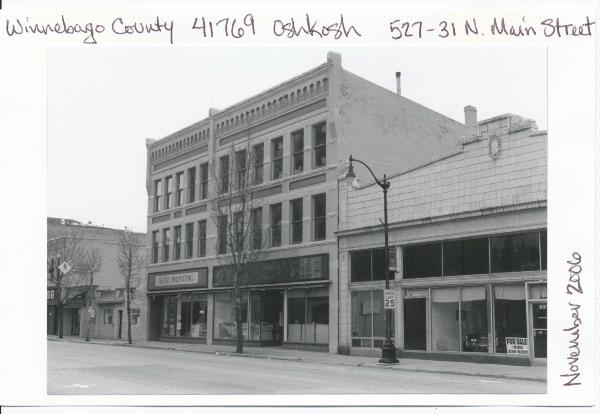

"The projects span across the state with an increasing emphasis on communities with populations of under 100,000 over time (69.4% in 2016)."

MYTH: THIS STATE OF WISCONSIN HANDOUT IS A HUGE DRAW ON THE STATE BUDGET

"Repayment of taxpayer funds in full by the beginning of 5 years of operations. Based solely on values subsequent to this repayment, the state receives 110% over its initial investment through year 10 of the projected assessment period based on a 3% annual trending rate."

MYTH: THIS PROGRAM IS DESIGNED TO ONLY HELP THE FEW

"During the construction period these projects are anticipated to generate over $683 million in direct economic output ($719 million overall).√√Direct new construction jobs of 9,882 based on 1,820 hours per job/year; (10,950 total).√√Total tax impact of $50.5 million in direct WI based construction activity - with overall tax impact of $92.4 million"

"Once placed in service the projects are projected to provide for roughly $149 million in direct economic output ($162 million overall). √√Direct permanent full-time equivalent (FTE) positions of 4,376 based on 1,820 hours per year; (4,700 total). √√Total tax impact of $25.9 million in direct operations activity with overall impact of $35.2 million annually."

"Cumulative increase in property tax payments of 633% post completion is anticipated ($19 million versus $3 million). √√Increases in school tax payments of $5.39 million or 592%. √Increases in WI Technical College receipts of roughly 532%."

WHY ARE TAX CREDITS IMPORTANT TO WISCONSIN?

These programs help create jobs both permanent and construction. These projects add revenue to any community in which they reside with increased property tax revenues and income tax revenue. The programs provide needed funds to encourage the retention of our historic places and are invaluable to Wisconsin’s economy. Below is a quote to another link to an opinion piece in the Journal Sentinel that is worth a read.

"What if I told you our state has an economic development tool that over a three-year period projects to generate more than $600 million in economic output, more than $90 million in new state tax revenue and more than 10,000 new jobs?" -Jim Villa via Journal Sentinel

ARE THE FEDERAL TAX CREDITS AT RISK UNDER THE CURRENT ADMINISTRATION?

If you’re new to the historic tax credit program take a few minutes to watch this video from the National Trust. Created by President Reagan's administration this program has been crucial to preservation across the country.

Thankfully while threatened under the recent rewriting of the tax code the advocacy of many has retained the Federal 20% tax credit. There's a lot of great information from the National Trust here including talking points and examples of projects if you're interested in becoming more involved as an advocate yourself. There's new uncertainty with the corporate tax rate cut from 35% to 21%. That may lessen the appetite for jumping through the hoops of the program. "Under the existing system, developers use the credit to offset their federal corporate tax liability. Or they can transfer the credit to corporate investors in exchange for a share of the ownership." (Blair Kamin, Chicago Tribune)

IS THERE A NEW PER PROJECT CAP OR A NEW YEARLY COMPETITION TO EARN NEW CREDITS IN WISCONSIN?

Governor Walker indicated his interest in placing a per project cap on new projects beginning in 2018 by adding a $500,000 per project cap veto in his budget proposal. The per project cap remains in the budget now passed by Wisconsin Legislator with the number raised to $3.5 million per project. While a cap is not ideal, this solution is considered a victory to keep development moving forward in Wisconsin. Many groups are thankful that the rumor of an introduction of a competition to determine which projects will receive funding in any given year did not become included with the changes. Check out this article outlining why the program worked so well.

HOW AM I ABLE TO HELP SUPPORT THE EFFORT TO KEEP THESE PROGRAMS IN PLACE BOTH HERE IN WISCONSIN AND NATIONALLY?

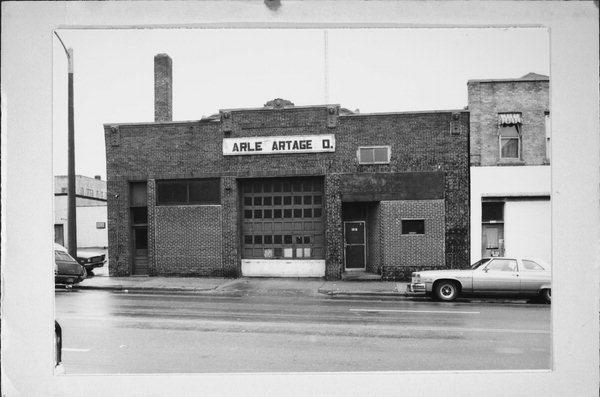

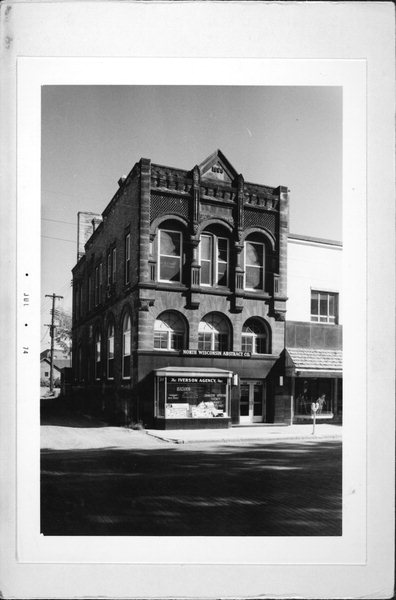

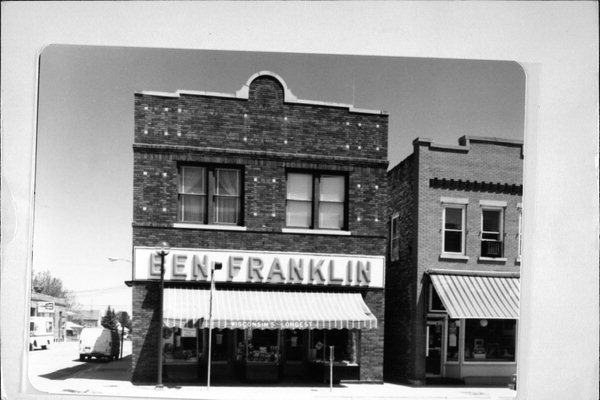

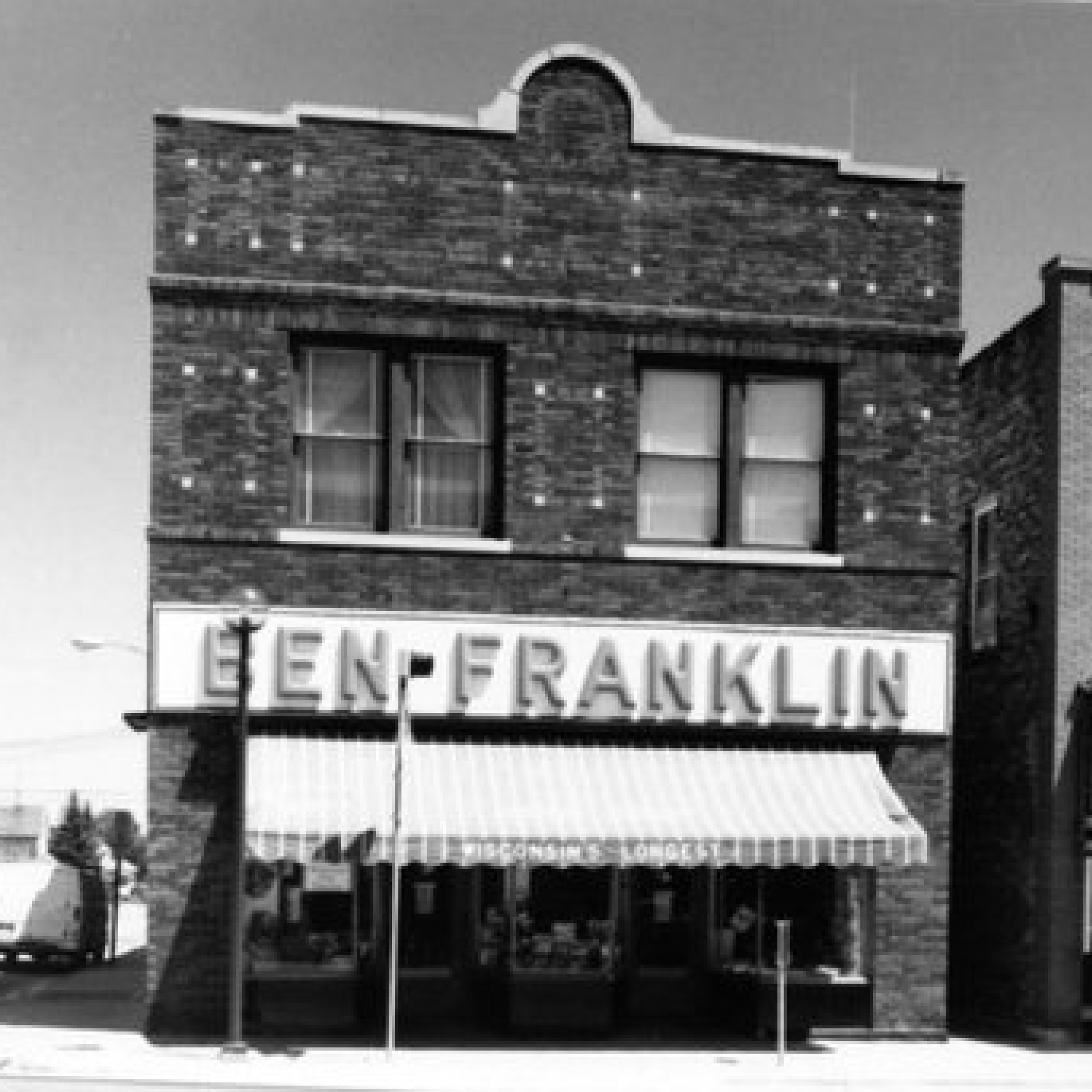

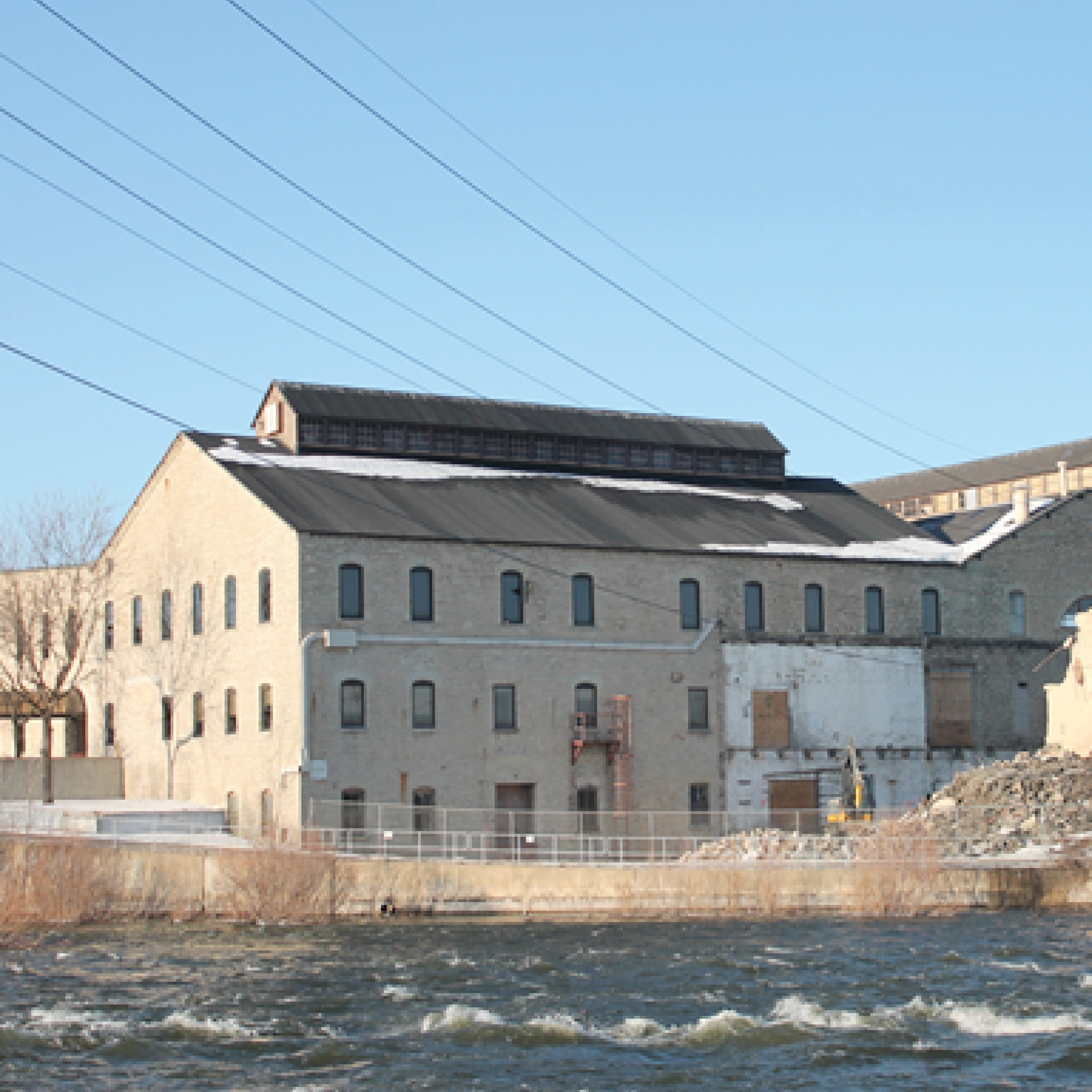

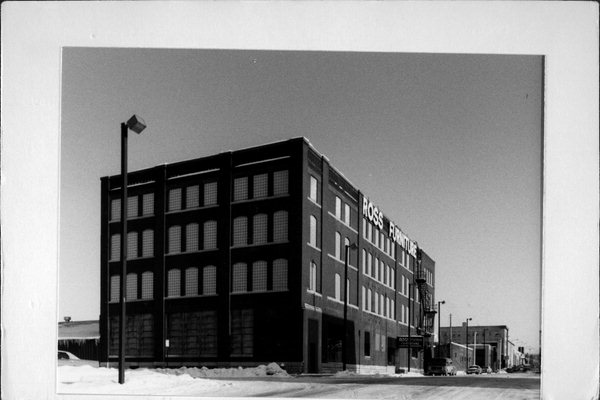

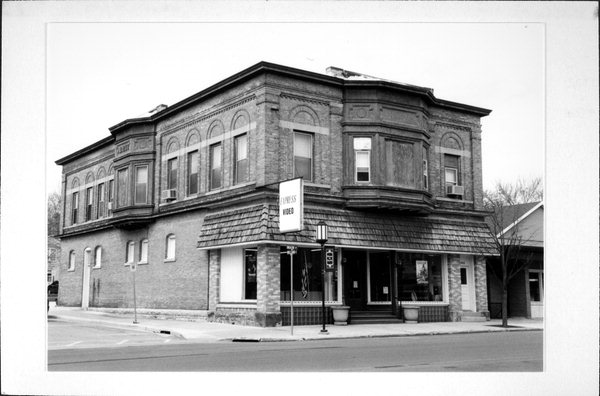

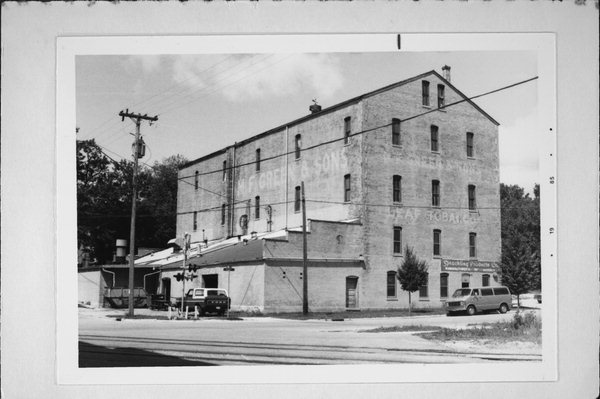

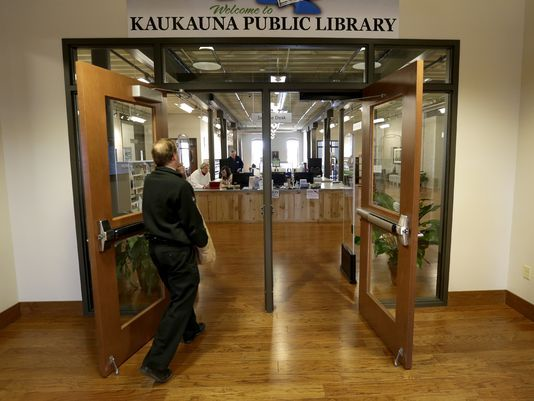

Attend local preservation group meetings, donate to organizations (like ours!!!) to help offset the costs of research supporting these dynamic programs that are currently scored statically and require lots of research footwork to keep in place, engage in conversations with your government representatives about the importance of these programs and keep in touch with activists fighting to increase public understanding. We’d also encourage you to be aware of and patronage businesses benefiting from the tax credit awards. We’ve created a map of past projects. Click below to see if there's a project near you. The program has been a catalyst for renewal in Main Streets across Wisconsin.

As always let us know your thoughts and other questions you may have!